Action with Confidence.

Whether you're a wholesaler or real estate investor, we provide quick funding for your deals—no credit check needed. We finance EMD, double closings, and even your down payment for a seller carry-back.

244

Deals Funded

$22.4M

Funded

132

Happy Borrowers

So What's It Cost?

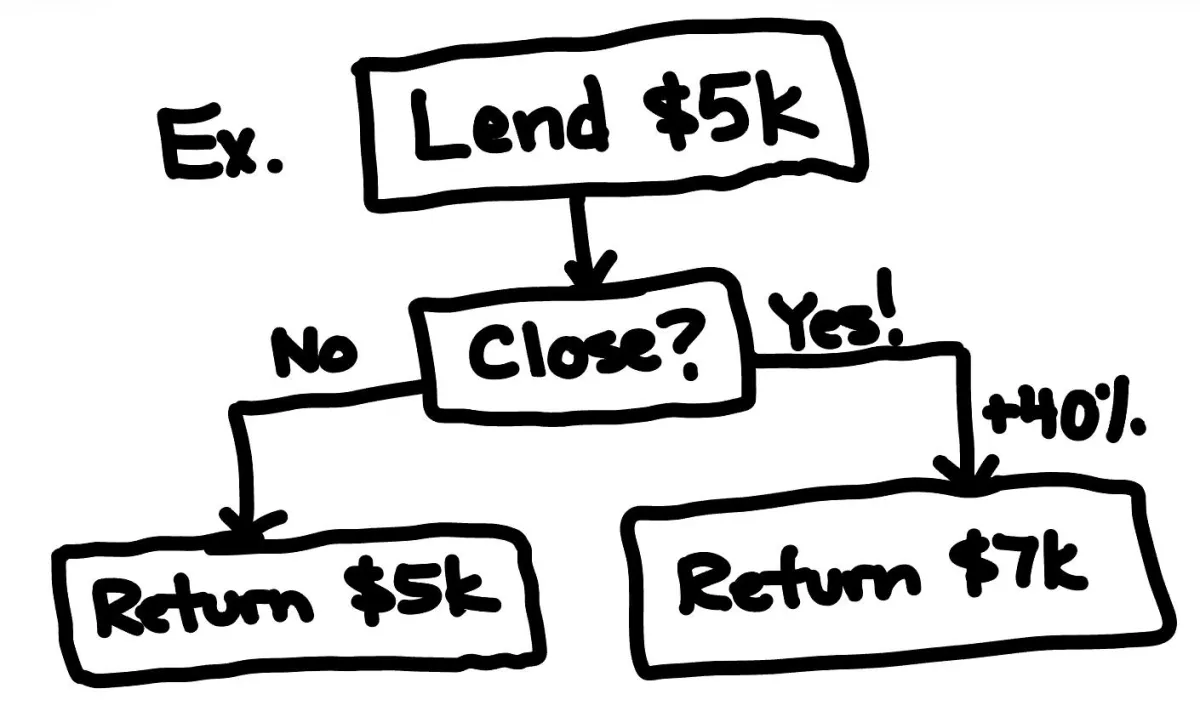

EMD Funding

We charge a flat 40% return on all EMD deals with a $1,500 minimum return. That means IF the deal closes, we would receive the initial amount plus 40%. We also charge a minimum $250 non-refundable fee prior to funding your deal to pay our transaction coordinator.

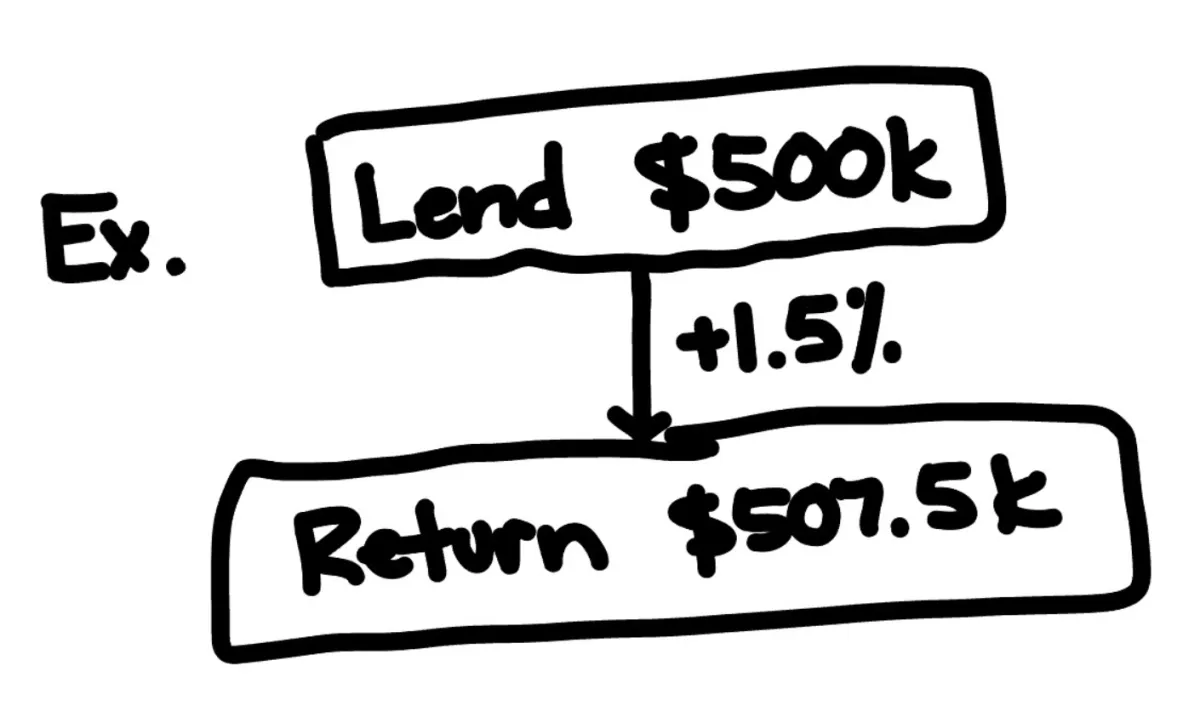

Double Close Funding

We charge a flat 1.5% fee on all double closings with at least 1 weeks notice. If you need the money quicker than that we will have to review to confirm. Our minimum return is $1,500 on smaller deals.

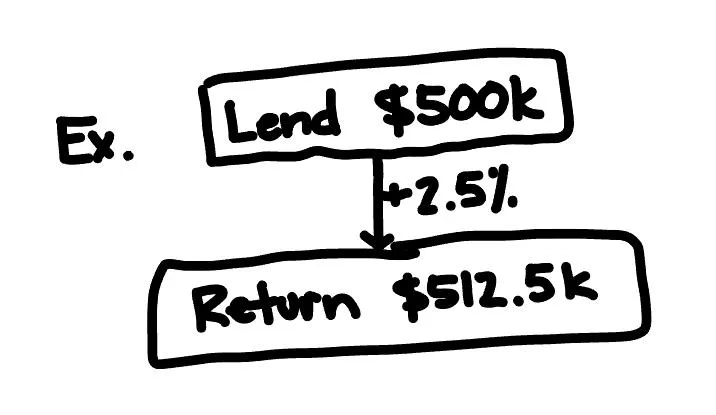

Seller Carryback Funding

We charge a flat 2.5% minimum fee on seller carry-back deals with at least 1 weeks notice. If you need the money quicker than that we will have to review to confirm. Our minimum return is $1,500 on smaller deals.

Frequently Asked Questions

How much do you charge?

We charge 40% return for lending EMD and 1.5% for double closings to start. We also fund seller carry-backs starting at 2.5%.These numbers can change depending on duration of the deal and risks involved.

Are there any up-front fees?

For EMD, we charge minimum $250 to pay our team for underwriting and processing the deal. Sadly we must do this so we don't end up losing money by funding your cancelled deal. If you are confident in your deal closing, this will have no effect on you!

What qualifies as double closing?

A double closing is a real estate strategy where two back-to-back transactions take place on the same day, involving three parties: the original seller, an investor (acting as the middleman), and the end buyer.

Here’s how it works:

First Transaction: The investor contracts to buy the property from the original seller.

Second Transaction: The investor immediately resells the property to the end buyer at a higher price.

In most cases, the investor uses the end buyer’s funds to finalize the purchase from the original seller. This allows them to profit from the price difference without tying up their own capital for long.

Double closings are commonly used in real estate wholesaling and transactional funding, enabling investors to facilitate deals efficiently while profiting by connecting motivated sellers with buyers.

What qualifies as a seller carry-back (Stack Method)?

A seller carry-back deal involves a hard money or DSCR loan being used to purchase a property. The remaining amount needed for purchase is funded by the seller via a seller carry-back. This amount is typically equal to the down-payment and closing costs.

If you have a deal like this, the lender will likely require you to bring the down-payment to close and then be reimbursed by the seller carry-back. IF the lender approves, we can fund that down-payment for you to close the deal.

Can you fund EMD for end buyers?

We can fund EMD for end buyers, but it's rare. At the end of the day, our funds have to be protected no matter what. Typically that is done through an inspection period. If you have no inspection period on your deal or the EMD is non-refundable we will not fund your deal.

If however the inspection period goes through the closing and you have a commitment letter from your lender to close on the deal, we may be able to fund it.

Is there a max amount you can fund?

We will fund deals up to $10M as long as the deal qualifies under our standards and requirements. We will be your one stop shop for all transactional funding both now and in the future!

How quickly can we get our deal funded?

We typically require 48 hours of notice to fund a deal, however we have funded in as quickly as 5 minutes (seriously). If you have a deal, your best bet is to submit it as soon as possible so we can review it and get the process started.

What happens if the deal doesn't close?

If your deal does not close, we do not charge you the 40% fee. Your only cost would be the up front fee since our transaction coordinators have already worked on the deal for you.

Copyrights 2025 | Transact Funds